LTC Price Prediction: Technical Breakout and Regulatory Tailwinds Signal Growth Potential

#LTC

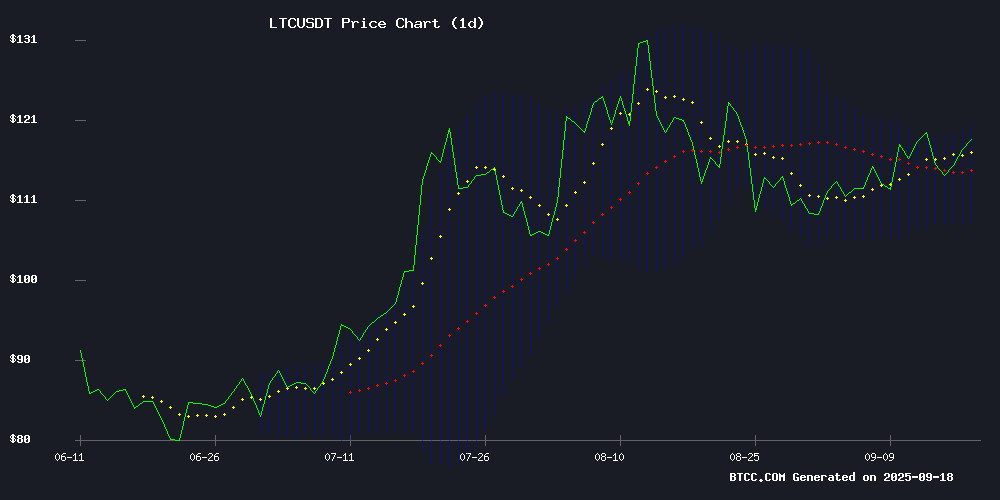

- LTC trading above 20-day moving average indicates bullish technical momentum

- MACD showing weakening bearish signals with improving momentum indicators

- Regulatory developments including ETF standards approval creating positive market sentiment

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

LTC is currently trading at $118.30, above its 20-day moving average of $113.89, indicating potential upward momentum. The MACD reading of -2.6157 shows bearish momentum is weakening, while the price trading NEAR the upper Bollinger Band at $119.94 suggests increased buying pressure. According to BTCC financial analyst Robert, 'LTC's position above key technical levels and approaching the upper Bollinger Band indicates strengthening bullish sentiment in the short term.'

Market Sentiment Boosted by Regulatory Developments

The cryptocurrency market is experiencing positive momentum with a 1.6% overall rise, supported by the SEC's approval of generic listing standards for crypto ETFs. This regulatory clarity is creating favorable conditions for major cryptocurrencies including LTC. BTCC financial analyst Robert notes, 'The ETF developments and expanding institutional access through platforms like Santander's Openbank are providing fundamental support for digital assets, with LTC positioned to benefit from these broader market tailwinds.'

Factors Influencing LTC's Price

Dogecoin ETF Launch Sparks Market Rally as DOGE Prices Surge 12%

The debut of the first U.S. Dogecoin ETF has ignited a fervor in the cryptocurrency market, sending DOGE prices soaring to $0.28—a 12% rebound from Tuesday's low of $0.25. Analysts speculate the ETF could propel DOGE beyond the $1 threshold, leveraging growing institutional interest.

ProfitableMining users are capitalizing on the volatility, reportedly earning $6,100 daily through advanced mining techniques. The 'DOGE + ETF' narrative has dominated social media chatter, underscoring retail enthusiasm for the meme coin's newfound legitimacy.

Dogecoin's Proof-of-Work mechanism and merged mining with Litecoin continue to attract miners, offering low-cost transactions and rapid block times. This infrastructure synergy positions DOGE uniquely among speculative assets.

XRP Holders Flock to Cloud Mining as LTCCloudMining Gains Traction

Ripple's XRP continues to dominate crypto market discussions, with trading volumes solidifying its position among the top digital assets this year. Investors are increasingly bridging their holdings to utility—cloud mining platforms like LTCCloudMining now offer a seamless entry point.

Launched in 2015, the UK-based platform serves 1.8 million users by eliminating hardware costs and energy overhead. Flexible computing power contracts enable daily cryptocurrency payouts, attracting XRP holders seeking passive income streams. "The shift reflects broader demand for turnkey crypto yield solutions," observes a sector analyst.

LTCCloudMining's tiered contracts cater to diverse risk appetites, from micro-investors to institutional participants. The model capitalizes on Bitcoin's halving-driven scarcity narrative while sidestepping traditional mining barriers.

Reddit Highlights Top Australian Online Casinos for 2025 with Crypto Integration

Australian gamblers on Reddit have identified BitStarz, JACKBIT, 7Bit Casino, KatsuBet, and MIRAX Casino as the leading online platforms for real-money payouts in 2025. These casinos distinguish themselves with crypto-friendly features, including Bitcoin (BTC) and ethereum (ETH) transactions, alongside traditional payment methods.

BitStarz emerges as a standout with its decade-long reputation, Curacao eGaming license, and 300% welcome bonus up to $10,000. The platform's emphasis on security and rapid payouts aligns with the growing demand for blockchain-based gambling solutions. JACKBIT's no-KYC policy and 30% rakeback offer cater specifically to privacy-focused crypto users.

The sector's evolution reflects broader fintech trends, with these casinos supporting digital assets like Litecoin (LTC) and Bitcoin SV (BSV) alongside fiat currencies. This convergence of iGaming and cryptocurrency markets creates new opportunities for exchanges like Binance and Coinbase to facilitate seamless fund transfers for players.

Cryptocurrency Market Rises 1.6% Amid Mixed Performance Among Major Tokens

The cryptocurrency market cap climbed to $4.19 trillion as trading volume hit $211.5 billion, reflecting robust investor participation. Bitcoin edged up 0.6% to $117,147, though it faces stiff resistance at $118,000. Ethereum dipped 0.2% to $4,578, while altcoins like Litecoin and OKB surged 3.3% and 4.9% respectively.

ETF flows showed divergence—Bitcoin products saw $51.28 million in outflows despite iShares adding $149.73 million. Ethereum ETFs recorded $1.89 million in redemptions, though BlackRock's fund attracted $25.86 million. Market sentiment remains neutral with the Fear & Greed Index holding at 51.

Small-cap tokens dominated gains, with one project rocketing 363.4% and another climbing 284.1%. Traders now await macroeconomic catalysts for the next directional MOVE as technical barriers loom for major assets.

Which Altcoins Stand to Gain from the SEC’s New ETF Listing Standards?

The SEC's streamlined ETF approval framework opens doors for a wave of digital asset ETFs, with Grayscale leading the charge. Its Digital Large Cap Fund (GDLC) has secured approval under the new standards, marking the US's first diversified multi-crypto ETP. The fund includes Bitcoin, Ethereum, XRP, Solana, and Cardano.

Bloomberg's Eric Balchunas notes that 12-15 cryptocurrencies now qualify for spot ETF consideration, provided they have six months of futures trading on Coinbase Derivatives. Eligible altcoins span from major players like Dogecoin and Litecoin to emerging tokens, signaling a broader institutional embrace of crypto diversity.

SEC Approves Generic Listing Standards for Crypto ETFs, Accelerating Market Access

The U.S. Securities and Exchange Commission has greenlit generic listing standards for commodity-based trust shares, a move that could significantly streamline the approval process for spot crypto exchange-traded funds. Nasdaq, Cboe, and the New York Stock Exchange can now list such products under uniform requirements without filing individual Rule 19b-4 applications.

"This decision ensures our capital markets remain at the forefront of digital asset innovation," said SEC Chair Paul Atkins. The approval includes Grayscale's Digital Large Cap Crypto Fund, marking a pivotal moment for institutional crypto adoption. Commodities underlying these products must either trade on ISG-member markets or serve as futures contract bases.

Santander's Openbank Launches Retail Crypto Trading in Germany with Plans for EU Expansion

Openbank, the digital arm of Spanish banking giant Banco Santander, has begun offering cryptocurrency trading services to retail customers in Germany. The platform enables users to buy, sell, and hold Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polygon (MATIC), and Cardano (ADA) directly within their existing bank accounts—eliminating the need for external exchanges.

The service, embedded within Openbank's investment interface, charges a 1.49% transaction fee with a €1 minimum per trade. Notably, the bank imposes no custody fees for asset storage, positioning the offering as a cost-effective solution for buy-and-hold investors. A phased rollout will bring the feature to Spain within weeks, followed by other EU markets later this year.

Santander's move signals deepening institutional adoption of digital assets among traditional finance players. The initial token selection prioritizes liquidity and demand, with plans to expand the portfolio in future updates. This development follows similar crypto integrations by European lenders like BNP Paribas and Deutsche Bank.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The price trading above the 20-day MA and approaching the upper Bollinger Band suggests bullish momentum. Additionally, regulatory progress with ETF standards and expanding institutional access create favorable fundamental conditions.

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $118.30 | Above MA |

| 20-day MA | $113.89 | Support Level |

| Upper Bollinger | $119.94 | Resistance Target |

| MACD | -2.6157 | Momentum Improving |

BTCC financial analyst Robert emphasizes that 'the combination of technical strength and regulatory tailwinds makes LTC well-positioned for potential growth in the current market environment.'